Charitable Contributions

Capital gains tax strategies—You can use charitable contributions to reduce your capital gains tax liability by donating long-term appreciated assets. Not only can you deduct the fair market value of what you give from your income taxes, you can also minimize capital gains tax of up to 20 percent.

There is a special rule that allows businesses to make enhanced deductions for contributions of food inventory for the care of the ill, needy, or infants. The deduction is limited to a percentage of the taxpayer’s aggregate net income or taxable income, usually set at 15%. In 2020, business taxpayers may deduct qualified contributions of up to 25% of their aggregate net income or taxable income for contributions of food inventory.

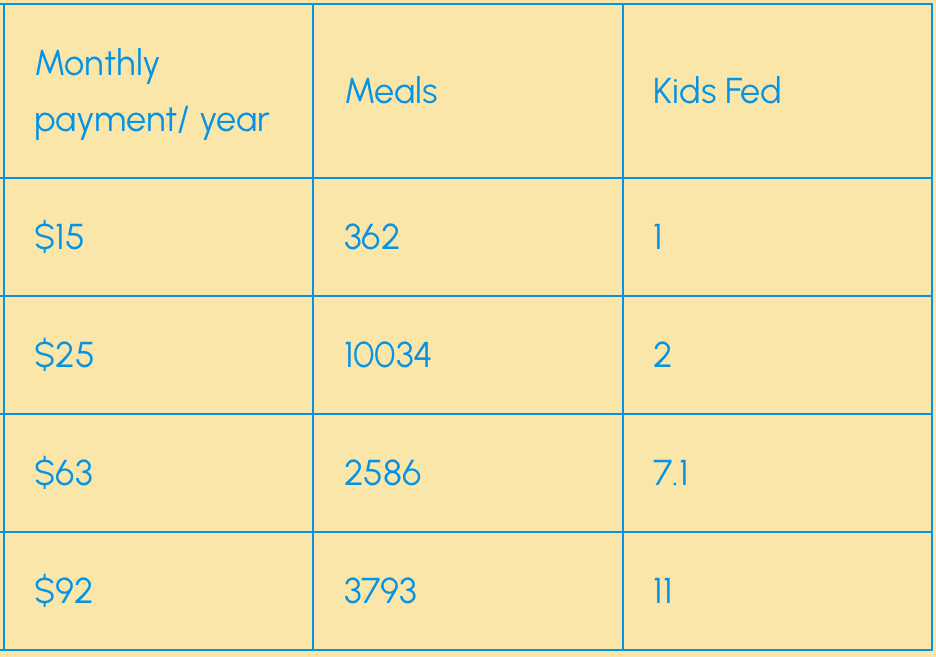

Ray Of Hope For Children

Ending child hunger one meal at the time